भारत (India) के PM नरेंद्र मोदी (Narendra Modi) 1 करोड़ सब्सक्राइबर्स (Subscribers) के साथ YouTube पर सबसे अधिक सब्सक्राइबर्स वाले वैश्विक नेता (Global Leader) बन गए हैं.

Showing posts with label General awareness. Show all posts

Showing posts with label General awareness. Show all posts

पाकिस्तान के खैबर पख्तूनख्वा प्रांत में 1800 साल पुरानी बौद्ध कलाकृतियां मिलीं

पाकिस्तान में पुरातत्वविदों ने देश के खैबर पख्तूनख्वा प्रांत में 1800 साल पुरानी 400 से अधिक बहुमूल्य बौद्ध कलाकृतियों की खोज की है.

Gautam Adani बने Asia में सबसे अमीर

भारतीय अरबपति कारोबारी गौतम अडानी (Gautam Adani) अब मुकेश अंबानी (Mukesh Ambani) को पछाड़ कर एशिया के सबसे अमीर व्यक्ति (Asia's Richest Person) बन गए हैं.

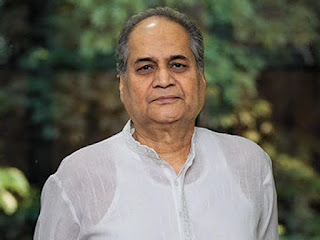

उद्योगपति राहुल बजाज का निधन

उद्योगपति राहुल बजाज का पुणे में निधन हो गया. वो 83 वर्ष के थे. राहुल बजाज करीब 50 सालों तक बजाज ग्रुप के चेयरमैन रहे थे.

Union Budget 2022 Highlights

Finance Minister Nirmala Sitharaman today presented the Union Budget 2022 in the second year of the COVID-19 pandemic.

- 60 lakh new jobs to be created under the productivity linked incentive scheme in 14 sectors.

- PLI Schemes have the potential to create an additional production of Rs 30 lakh crore.

- Entering Amrit Kaal, the 25 year long lead up to India @100, the budget provides impetus for growth along four priorities:

PM GatiShakti

- Inclusive Development

- Productivity Enhancement & Investment, Sunrise opportunities, Energy Transition, and Climate Action.

- Financing of investments

Banking- CAPITAL MARKET

Capital market deals with medium term and long term funds. It refers to all facilities and the institutional arrangements for borrowing and lending term funds (medium term and long term). The demand for long term funds comes from private business corporations, public corporations and the government. The supply of funds comes largely from individual and institutional investors, banks and special industrial financial institutions and Government.

B) STRUCTURE I CONSTITUENTS I CLASSIFICATION OF CAPITAL MARKET :-

Capital market is classified in two ways

1) CAPITAL MARKET IN INDIA

a) Gilt - Edged Market

b) Industrial Securities Market

c) Development Financial Institutions

d) Financial Intermediaries

B) STRUCTURE I CONSTITUENTS I CLASSIFICATION OF CAPITAL MARKET :-

Capital market is classified in two ways

1) CAPITAL MARKET IN INDIA

a) Gilt - Edged Market

b) Industrial Securities Market

c) Development Financial Institutions

d) Financial Intermediaries

Money Market

A money market is a market for borrowing and lending of short-term funds. It deals in funds and financial instruments having a maturity period of one day to one year. It is a mechanism through which short-term funds are loaned or borrowed and through which a large part of financial transactions of a particular country or of the world are cleared.

It is not a single market but a collection of markets for several instruments like call money market, Commercial bill market etc. The Reserve Bank of India is the most important constituent of Indian money market

In money market the players are :-Government, RBI, DFHI (Discount and finance House of India) Banks, Mutual Funds, Corporate Investors, Provident Funds, PSUs (Public Sector Undertakings), NBFCs (Non-Banking Finance Companies) etc.

It is not a single market but a collection of markets for several instruments like call money market, Commercial bill market etc. The Reserve Bank of India is the most important constituent of Indian money market

In money market the players are :-Government, RBI, DFHI (Discount and finance House of India) Banks, Mutual Funds, Corporate Investors, Provident Funds, PSUs (Public Sector Undertakings), NBFCs (Non-Banking Finance Companies) etc.

SEBI- Securities and Exchange Board of India

Securities and Exchange Board of India (SEBI) was established by Government of India through an executive resolution in the year 1988. SEBI was subsequently upgraded as a fully autonomous body in 1992 with the passing of the Securities and Exchange Board of India Act (SEBI Act) on 30th January 1992. In the year 1995, the SEBI was given additional statutory power by the Government of India through an amendment to the securities and Exchange Board of India Act 1992.

1. The headquarter of SEBI is located in the business district of Bandra-Kurla complex in Mumbai.

2. The Chairman of SEBI – Upendra Kumar Sinha (UK Sinha)

3. The Whole Time Member of SEBI- Prashant Saran

RTGS

Q1. What is RTGS System?

Ans. The acronym 'RTGS' stands for Real Time Gross Settlement,

which can be defined as the continuous (real-time) settlement of funds

transfers individually on an order by order basis (without netting).

'Real Time' means the processing of instructions at the time they are

received rather than at some later time; 'Gross Settlement' means the

settlement of funds transfer instructions occurs individually (on an

instruction by instruction basis). Considering that the funds settlement

takes place in the books of the Reserve Bank of India, the payments

are final and irrevocable.FLAGSHIP SCHEMES OF GOVERNMENT

FLAGSHIP SCHEMES OF GOVERNMENT

1. BHARAT NIRMAN:

Componets-1. Road 2. Irrigation 3. Drinking Water 4. Electricity 5. Houses 6. Communicaton

• It was implemented and extended in three phases i.e., from (2005 - 2009), (2009 - 2012), (2012- 2014)

• It is centrally sponsored scheme for the rural development of India started in September 2005.

• There are 6 objectives in this scheme

Objectives:

a) To provide all weather road connectivity to the village which have more than 1000 population in plain areas and 500 population in hilly areas.

1. BHARAT NIRMAN:

Componets-1. Road 2. Irrigation 3. Drinking Water 4. Electricity 5. Houses 6. Communicaton

• It was implemented and extended in three phases i.e., from (2005 - 2009), (2009 - 2012), (2012- 2014)

• It is centrally sponsored scheme for the rural development of India started in September 2005.

• There are 6 objectives in this scheme

Objectives:

a) To provide all weather road connectivity to the village which have more than 1000 population in plain areas and 500 population in hilly areas.

Banking Ombudsman, 2006

1. What is the Banking Ombudsman Scheme?

The Banking Ombudsman Scheme enables an expeditious and inexpensive forum to bank customers for resolution of complaints relating to certain services rendered by banks. The Banking Ombudsman Scheme is introduced under Section 35 A of the Banking Regulation Act, 1949 by RBI with effect from

1995.

2. Who is a Banking Ombudsman?

The Banking Ombudsman is a senior official appointed by the Reserve Bank of India to redress customer complaints against deficiency in certain banking services.

Banking Notes- Budget and its types

Budget- Budget is the estimation of income and expenditure.

Budget is prepared for proper and systematic development.

Budget represent in 3 ways-

1. Income> expenditure= surplus

2. Income= expenditure= balance budget

3. Income< expenditure = deficit budget

Note- India's budget is always deficit because India is a developing country.

Budget is prepared for proper and systematic development.

Budget represent in 3 ways-

1. Income> expenditure= surplus

2. Income= expenditure= balance budget

3. Income< expenditure = deficit budget

Note- India's budget is always deficit because India is a developing country.

Banking Notes- Reserve Bank Of India

Dear Redaers, we are presenting Banking Notes- Reserve Bank Of India. It will help you in Banking section of exams.

Establishment

The Reserve Bank of India was established on

April 1, 1935 in accordance with the

provisions of the Reserve

Bank of India Act, 1934.

provisions of the Reserve

Bank of India Act, 1934.

provisions of the Reserve

Bank of India Act, 1934.

provisions of the Reserve

Bank of India Act, 1934.

The Central Office

of the Reserve Bank was initially established in Calcutta but was permanently

moved to Mumbai in 1937. The Central Office is where the Governor sits and where

policies are formulated.

Though originally

privately owned, since nationalisation in 1949, the Reserve Bank is fully owned

by the Government of India.

NEFT

Q.1. What is NEFT?

Ans: National Electronic Funds Transfer

(NEFT) is a nation-wide payment system facilitating one-to-one funds

transfer. Under this Scheme, individuals, firms and corporates can

electronically transfer funds from any bank branch to any individual,

firm or corporate having an account with any other bank branch in the

country participating in the Scheme.

Q.2. Are all bank branches in the country part of the NEFT funds transfer network?

Ans: For being part of the NEFT funds

transfer network, a bank branch has to be NEFT- enabled. The list of

bank-wise branches which are participating in NEFT is provided in the

website of Reserve Bank of India

Subscribe to:

Posts (Atom)